私たちは、ランキングサイト、グーグルマップのMEO、グーグル検索のSEOなど、多岐にわたるランキングのメカニズムとその影響を深く理解しています。これらのランキングは、様々なランキングをサイトを適切に理解して、適切な投資をすることで、会社の成長に寄与します。

ランキングサイト

様々な業界やカテゴリーにおいて、高いランキングはブランドやサービスの信頼性を高め、多くの新規顧客を引き寄せる要因となります。良好な評価やレビューは、消費者の選択を大きく左右します。

グーグルマップのMEO

グーグルマップのMEO: 地域密着型のビジネスにとって、グーグルマップ上での高いランキングは、地域の顧客からのアクセスや問い合わせの増加をもたらします。

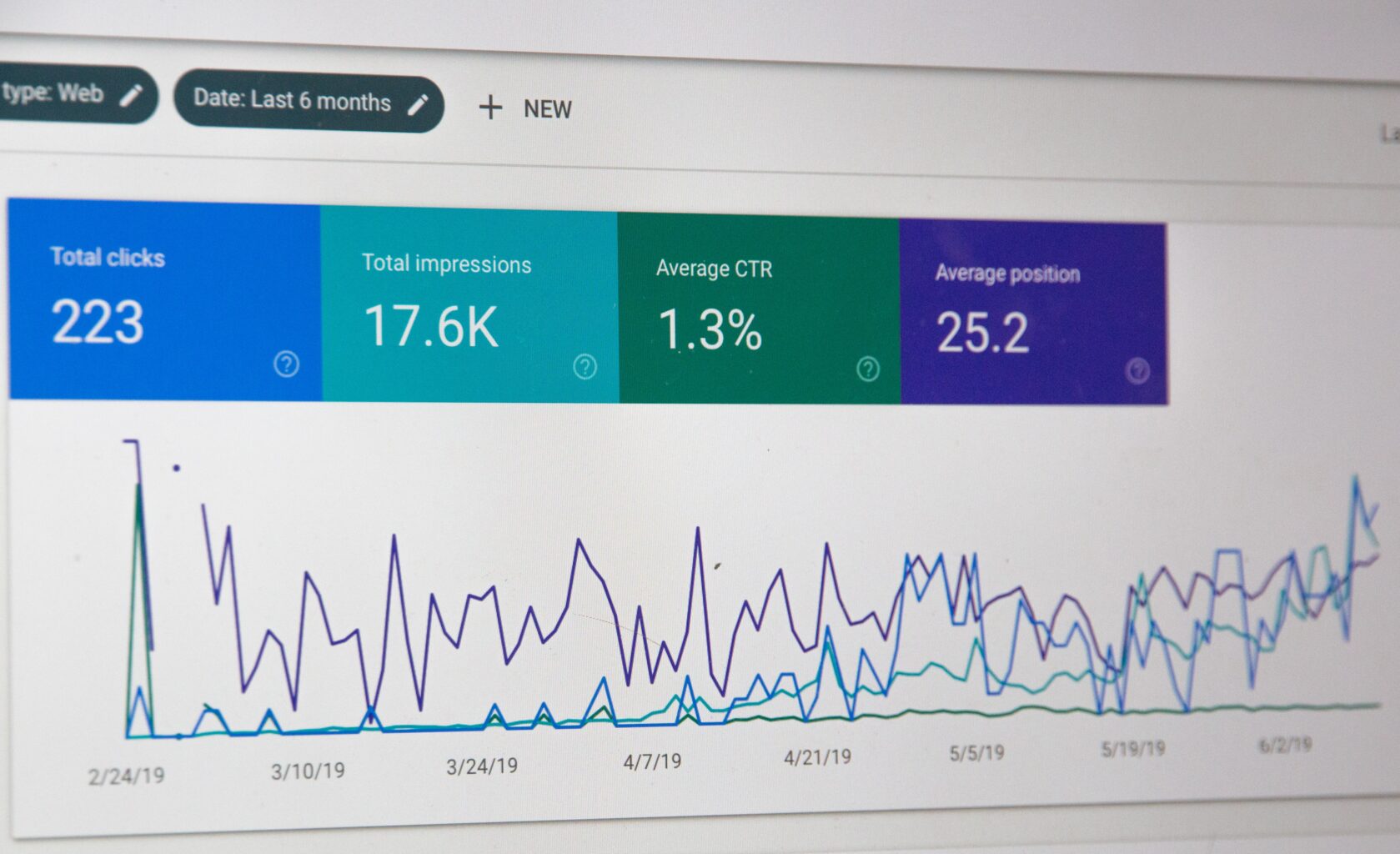

グーグル検索のSEO

ウェブサイトのトラフィックを増加させるためには、検索エンジンでの上位表示が不可欠です。高いSEOランキングは、ブランドの認知度や信頼性を向上させるだけでなく、質の高いリードを獲得する手助けとなります。